Does Insurance Cover Injuries After an Accident?

With all the money you put into monthly insurance payments, it makes sense that you expect your injuries to be covered when you have an accident. However, filing an insurance claim isn’t always as simple as it should be. What kind of claim do you need, a first-party or a third-party claim? How do you know, and what should you do to file the claim? The good news is that in many cases, an insurance company will cover injuries after an accident. Unfortunately, filing a claim is not always simple, and it often requires assistance from a personal injury attorney.

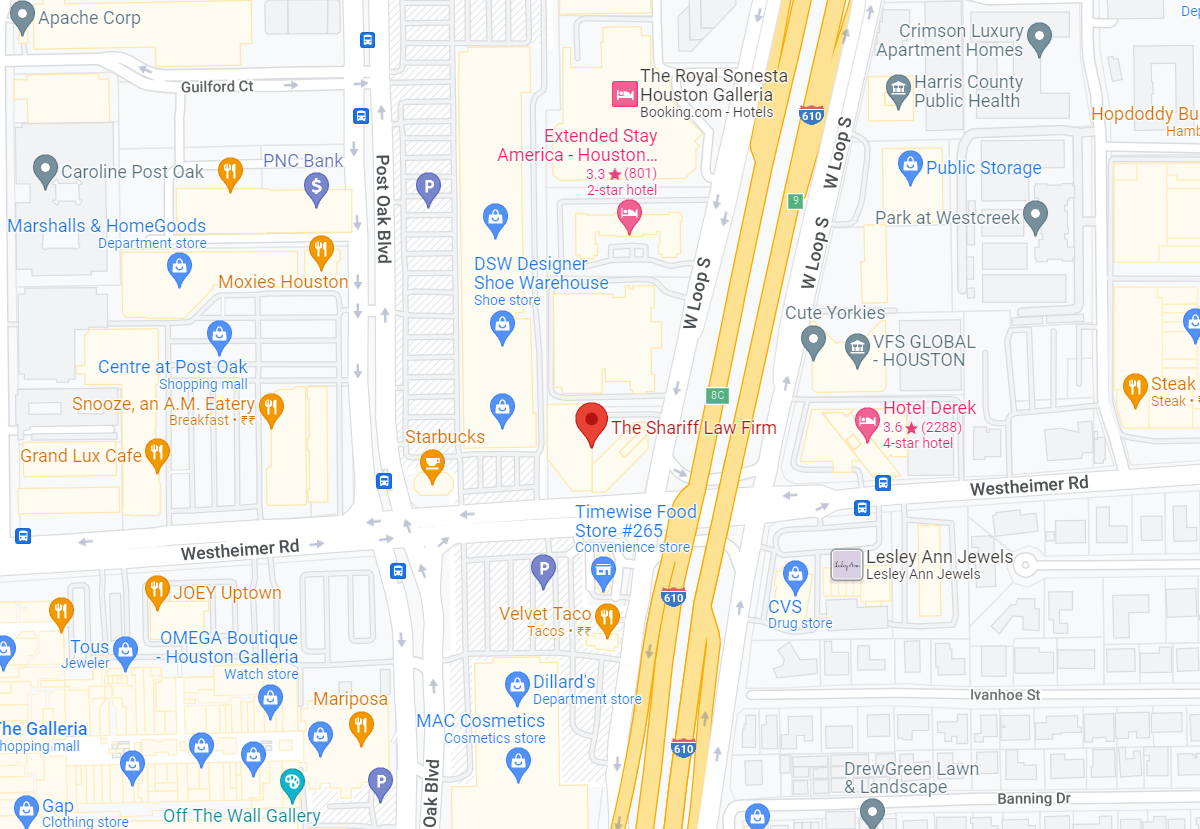

If you need insurance payment for injuries caused in an accident, one of the best choices you can make is to contact a personal injury lawyer. Your attorney can communicate with insurance companies to ensure your claim is filed correctly and that you get a fair settlement. While some insurance companies will offer you a settlement, many insurance companies will attempt to reject your claim or give you a smaller payout than you need. If you are seeking compensation after an accident, contact Shariff Law Firm, PLLC for assistance by calling 713-244-8392 today.

What Is a First-Party Insurance Claim?

A first-party claim is an insurance claim made by a person against their own policy. In the State of Texas, this type of claim is based on a fiduciary relationship between the insurance company and the individual. This means the company should be loyal to their customer and act in good faith on their behalf. In most cases, a first-party insurance company covers things like health insurance, auto insurance, and renter’s insurance.

If the insurance company fails to make a fair deal when paying your losses, this could indicate a breach of contract or other insurance bad faith. If you think an insurance company has not treated you fairly, contact a trusted legal representative right away.

Examples of a first-party insurance claim include:

- Medical bills

- Property damage

- Collision repairs

- Reimbursement for a rental car

- Health insurance

- Uninsured motorist coverage

- Coverage under a renter’s insurance policy

What Is a Third-Party Insurance Claim?

With third-party claims, a person makes a claim against the at-fault party’s insurance policy. The injured person is not under contract with the insurance company, so there is no fiduciary relationship. Third-party claims can still be helpful when seeking compensation for injuries caused by someone else’s negligence. In most cases, third-party claims will be made to liability insurance companies, like auto insurance, homeowner’s insurance, or commercial insurance.

If you need help filing a third-party claim for your injuries, a personal injury lawyer can help. They will communicate with insurance agents and fight for a positive outcome on your behalf.

Examples of a third-party insurance claim include:

- Auto accidents

- Animal liability

- Truck accidents

- Motorcycle accidents

- Product liability

- Slip and fall accidents

What is Bad Faith in Insurance Claims?

Unfortunately, bad faith may impact your insurance claim after an accident. Bad faith refers to any actions on the part of the insurance company to deny or dismiss a claim unfairly. In first-party claims, bad faith actions may include insurers refusing to investigate a claim or denying a claim without proper investigation. Insurers may also engage in insufficient processing or delayed payment.

In third-party claims, bad faith actions can include insurers who don’t meet the policy limits for their claims, altering paperwork without the customer’s consent, misrepresenting claims, failing to act in a timely manner, or denying legitimate claims.

If you have encountered any bad faith actions in your insurance claim, reach out to an attorney immediately. Our team can help you hold insurance agents accountable and seek the compensation you need after being injured.

Can You Seek Compensation for Bad Faith Claims?

If you have been a victim of bad faith claims, you can seek compensation in a personal injury case. Our team can assist you in seeking compensation for what you have gone through.

You may be able to seek the following in a bad-faith claim:

- Compensation up to three times the amount that the insurance company would have paid you

- Mental anguish or emotional suffering

- Any attorney fees, interest, and court costs

- Punitive damages

If you and your legal team can prove that the insurance company committed an intentional violation, then you may be able to receive compensation. However, the only way to seek punitive damages is if the insurance company acted in an especially egregious manner. Punitive damages serve as a punishment to discourage parties from repeating their actions in the future. Because punitive damages often amount to more than other damages, they can be more difficult to obtain. Contact our team if you would like to seek compensation for a bad-faith insurance claim.

Should You Hire Our Personal Injury Attorneys?

Negotiating with insurance companies is one of the most challenging parts of getting compensation for injuries. The company is usually looking out for its own interests rather than those of the customer. However, if an insurance company acts in bad faith and doesn’t treat the policyholder fairly, this could result in legal action. You deserve to have your claim taken seriously and get the compensation you deserve after injuries, property damage, and emotional suffering.

Please contact our talented legal team to help get the most out of your insurance claim. We understand the challenges you are going through with your accident claim, and we promise to stand by your side as you navigate this complicated process. If your case must go to court, we will fight aggressively for justice on your behalf. Call Shariff Law Firm, PLLC now at 713-244-8392.

CALL US NOW

CALL US NOW